MAXIMIZING YOUR EQUIPMENT: AN ANALYTICAL APPROACH

by Joe Sostaric

What often defines you as a pump company is the equipment that you own and operate. When you run across another pumper, the questions that are often asked first are where you are located and how many pumps you run. To pump concrete requires concrete pumps, which are the biggest capital expense for a pump company. Having the right amount of equipment in the right place is essential if you want to maximize profitability. Too little of the size needed and you risk the potential of unsatisfied customers going elsewhere to find the equipment they need. Too many pumps parked against the fence can mean your capital and operational costs can go through the roof.

LESSONS LEARNED

Some things that I learned about trying to optimize equipment:

- You will never always have the right amount of equipment. If you build your fleet based on peak days, you will be paying for more equipment than you can afford. If you build your fleet based on the slow season, you will lose business opportunities in the busy season as potential customers go elsewhere when you do not have the equipment to service their needs.

- You will never always have the right sizes of equipment. Some days, your schedule will be full of 20-meter pumps, while other days the schedule is full of nothing but big booms.

- If you have one specialty pump, it will either be ordered by two customers at the same time or will be in a location that is far away from where it is needed.

- Too many sizes of pumps in your fleet can cause you dispatching headaches. I have a customer that calls in an order for a 38-meter pump. I tell him that I am sending out my 36-meter pump that is located only 10 minutes from the job. He tells me he “has to have a 38-meter” (even though he has already ordered 100 feet of system with the pump).

- Related to the last point, it is advisable to quote and market pumps as a class size. By that I mean you quote a “56/58-meter pump” instead of a separate line item for each potential size. The more choices you give your customer, the more problems you will cause yourself on the back end.

- If you ask your sales staff and dispatchers, they will tell you they need more equipment all the time because they will need to have fewer conversations with their customers asking them to take a different size from what they ordered.

- More and more, fleet size is being dictated by the number of pumps you can man. If you cannot find and hire qualified pump operators, it will do you no good to buy another pump.

What can you do to make smart decisions on equipment purchases and disposals? There is talk about looking at utilization of pumps, but how do you track utilization? The basic way that many people track utilization is by looking at how many jobs were serviced in a prescribed timeframe. But is that a good way to do it? I have opinions, but here are some challenges and ideas to consider when trying to determine fleet size.

COST VS. BILLING

A big point about pump utilization is you do not make the same amount of money from each pump size! What you charge for each size and what it costs you to run each size varies significantly. Therefore, you need to have an idea of what you make for each piece of equipment you operate. This is the hardest thing to figure out, but it is the key in determining what pumps you should be investing in. Here is a simple way to look at this point:

I purchase a 20-meter pump for $500,000. My goal is that the pumps make enough money (profit) to pay for themselves in 10 years. Using simple math, this would mean I need to make $500,000 over 10 years or $50,000 per year, just to recoup the money I paid for the pump. This assumes I paid cash for the pump. If on average you are making $500 per day when you operate the pump, you will need the pump to work 100 days per year for the next 10 years.

I also purchase a 47-meter pump for $800,000. Once again, I want to make enough profit for this pump to recoup the money I paid for the pump in 10 years ($80,000 per year of profit). If on average I make $1,000 per day with the 47-meter, I will need it to work 80 days per year to get my money back. Therefore, I do not need for this pump to work as much as the 20-meter to reach my goals for profitability.

I want to buy one last pump. I want to purchase a 36-meter for $600,000 and need the pump to pay for itself in 10 years ($60,000 per year profit). I make $250 each day the pump goes out. This pump will need to work 240 days per year to reach my profit goals. Because there are only 249 working days (Monday through Friday, minus federal holidays), the only way I can hope to reach my profit goals will be to raise my prices for this size of pump.

As I mentioned earlier, tracking the number of jobs is not my preferred way of calculating utilization. I would prefer to track the number of days, the revenue and the costs generated per day. Why? Because small pumps often service multiple jobs during the day. If a line pump shows it serviced 100 jobs during the year but averages two jobs per day, that means it was only run 50 days out of the year.

DOWNTIME

Another key to searching for utilization information is to take into consideration the downtime of the equipment. Let’s say that in my fleet, I have five 38-meter pumps all parked at the same yard. Based on the average of all of the pumps, I typically run my 38-meter pumps 120 days per year. This is below my goal of 140 days, so I decide I am going to get rid of one of them. Looking through my data, I see that one of the pumps has been down an average of 50 days per year for the last three years. Although this pump has been utilized better than other 38-meter pumps that I have, its availability and maintenance make it the best candidate to be sold.

Not taking maintenance into consideration could also cause you to make an incorrect decision about a pump’s utilization. I have two 61-meter pumps that each need a new rear end. The part is backordered, causing these pumps to be down for three months each. If I look at a utilization report and don’t take this into consideration, it may cause me to decide that I need to get rid of a 61-meter pump because it is not being utilized enough to justify keeping it. Therefore, a good utilization report would show the downtime of the pump and the percentage of days that the pump was used when it was available for use (excluding days down for maintenance).

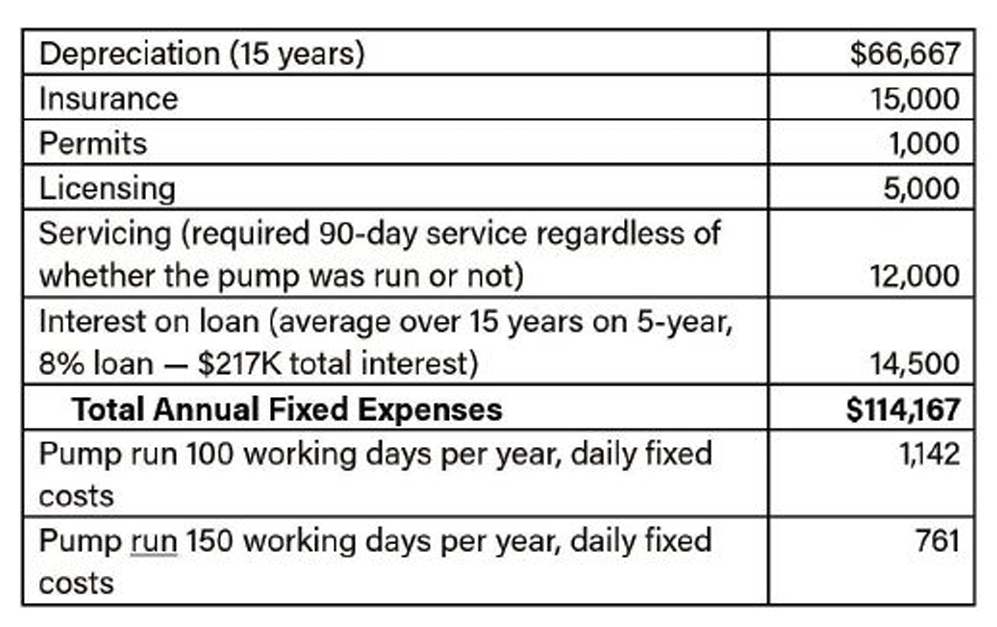

Pumps are a major expense for a pump company. When a pump is parked against the fence all day, the costs to a company rise, making it harder and harder to make money. Let’s look at what a pump that costs $1 million can cost a company annually in fixed costs alone under two different utilization scenarios. As the table shows, there are many fixed costs that go with equipment. Insurance, permitting, licensing and servicing requirements will vary state-by-state and company-by-company, but this example shows that the daily cost of operating that piece of equipment rises substantially when we do not utilize the equipment well. In our scenario, the daily fixed cost of the poorly utilized pump rises more than $381 for every job serviced by this pump. It is a fine line that we walk between catering to our customers’ needs and purchasing equipment in a fiscally responsible manner.

STAFFING CONSIDERATIONS

In addition, the more pieces of equipment you have, the more support staff you will need. The obvious staff needed to support an equipment fleet are the mechanics. In addition, larger companies can also have positions like parts managers, shop supervisors and support clerks. The amount of support staff you need is a function of the size of the fleet, so the bigger the fleet, the more overhead you will need to absorb.

An even bigger expense associated with underutilized equipment is often underutilized operators. If you have peaks and valleys that cause you to have days where you do not have work for your operators, you can stand the chance of losing operators due to lack of work. Operators need a steady paycheck, and if a company cannot provide them that, they will often go work for someone who will. To avoid this, pump companies sometimes bring in operators to do things other than pumping concrete, like washing pumps, changing gaskets or checking job sites. Although this work has value, it also adds to overhead, making it harder to make a profit. In most cases, you are better off if your pump operators spend the majority of their paid time pumping concrete.

THE AIRLINE INDUSTRY

Concrete pumping is not the only industry that must deal with utilization and the high cost of equipment. One of the best examples is the airline industry, and it might surprise you, but there are similarities between the concrete pumping industry and the airline industry. Let’s look at how airlines handle the challenges associated with fluctuating demand and the high cost of equipment, and how we might learn from practices they have adopted.

- The airline industry tracks travel trends and utilization of every route that it covers. If an airline flies a route that is consistently full, it will look to add a flight. If the planes are empty, routes get canceled.

- The airlines encourage their customers to book early. They get the lowest fares by booking in advance. Getting their customers to book in advance gives them better insight into operational challenges and potential profitability. If sales and occupancy look low, they will adjust their routes accordingly and send updates to customers that have already booked flights. Conversely, if customers wait until the last minute to book a flight, they can expect that the ticket will cost far more than for the person that booked their flight two months ago.

- The airlines overbook flights as part of their strategy to better utilize their expensive equipment. History tells them that a certain percentage of their customers will cancel flights. If you only sell tickets for the number of available seats you have, you will have empty seats when the plane takes off because of last-minute cancellations. Empty seats mean little or no revenue. In their quest to fully book flights, the airlines will bet on the trend of cancellations. Occasionally, there will be more passengers than seats, and they will incentivize some paid customers to give up their seats. It is worth it to offer a huge discount to a few customers, as this means that they are getting revenue on every seat on that plane. A plane might have 144 seats at an average of $400 per seat. That means the plane is bringing in $57,600. If the airlines had to pay three individuals $1,000 each to give up their seats voluntarily, the $3,000 in cost is justifiable based on the fares received from a full flight.

- They enter alliances with their competitors. It is not practical or economical for airlines to service every destination that their customers would like to travel to, so they enter alliances with competitors to assist their customers in getting them anywhere they might want to go. The airlines even make money by arranging flights on their competitors’ planes.

- Airlines will most often assist their customers in finding alternate travel when plans go awry. If a plane unexpectedly goes down for repairs, the airlines look to accommodate their passengers and will go as far as booking flights for them on their competitors’ planes.

- The airlines work to pass on unexpected sharp increases in operating expenses. When the price of jet fuel skyrocketed, a fuel surcharge was added to the cost of the plane ticket.

- The airlines do not bump their premier customers. They track the revenue generated by customer and reward their top customers. For example, a one-million-mile flier of an airline will get perks, like free upgrades to first class. Behind the scenes, they will also bump passengers with little or no history of flying with them to accommodate their gold card customers.

- Airlines adjust their fleet due to changing market conditions. Let’s say an airline services a smaller regional airport with a Boeing 737. The ticket prices they receive are good, but the occupancy is consistently below their standards. The airline will choose to change the plane servicing the route to a smaller and more economical regional jet.

- Airlines have also adopted additional fees that were once free. When American Airlines began charging customers $15 for checked baggage in 2008, there was a huge outcry. It was met with serious resistance, but soon all the major airlines except Southwest, adopted the practice. Congress even brought in airlines’ CEOs and chastised them about the exorbitant costs they were charging their customers. But even with the strong pushback, the airlines stuck to this practice and now charge $35 to $50 for the first bag, and even more for a second bag. Discount airlines and basic economy tickets may even have a charge for carry-on luggage. I did a quick inquiry on ChatGPT, and it tells me that the airlines collected $6.8 billion in baggage fees in 2022.

APPLYING LESSONS LEARNED

The lessons learned from how airlines operate can apply to concrete pump companies. Both industries have very high costs for equipment and low profit margins, making it essential to keep utilization numbers high. If you want to make money pumping concrete, you must utilize your equipment well. This means that there will be days when you cannot cover all the customer requests that you have with your own equipment. You will need a strategy on how you handle overbooked days. Do you have alliances with other pump companies that you can reach out to when you are short of equipment? Remember, your competitors are in the same position as you and they will have days when they will need the same type of help.

Do you and your staff go the extra mile to stay on top of your customers’ needs, or do you constantly allow your “best” customers to call you at the very last minute and demand the pump and operator that were already booked to someone else? As with the airlines, no customer wants to change their plans at the very last minute, but how the issue is handled will often define how the relationship between the customer and pump company continues.

And lastly, as I mentioned in a previous article, stop doing things for free that cost you money! As previously stated, airlines generated $6.8 billion in baggage fees in 2022. My friends at ChatGPT tell me that net profit for U.S. airlines in 2022 was between three and five percent for a combined $7.6 billion. Where would they be if it wasn’t for their baggage fees! Even Southwest Airlines, the only major holdout, just announced they will start charging baggage fees to their customers. Concrete pumping margins are equally low. Watch your equipment and get paid for all that you provide. If you have any questions, email joe[at]agiletq[dot]com.